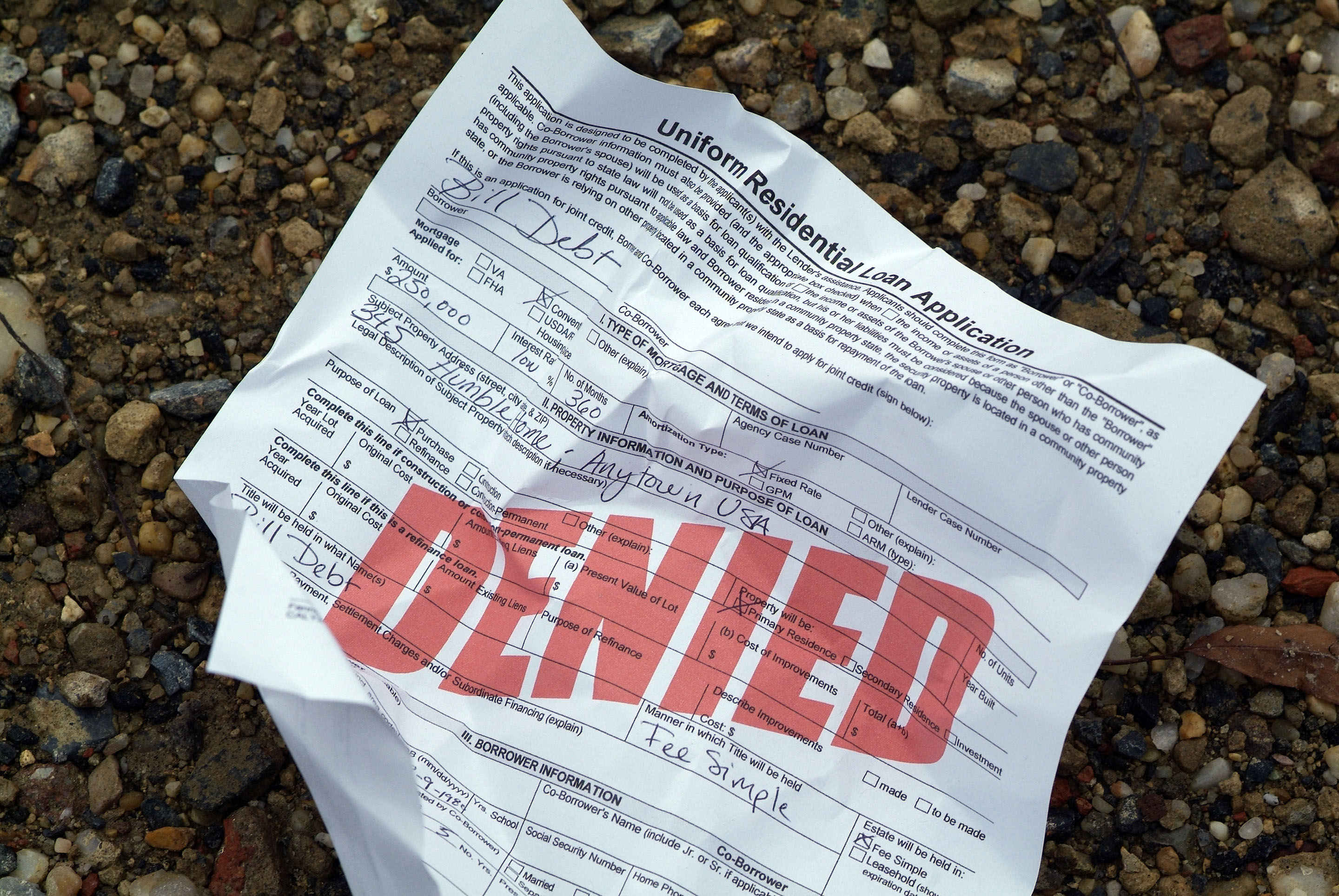

4 Important Mortgage Tips for First-Time Buyers

The spring-summer home buying season in high gear, and for first-time home buyers, finding an affordable dream home in today’s market could be quite a challenge. Then, after finding that ideal home, you have to secure a mortgage that makes financial sense both today and for the future. Here, Forbes offers some insider mortgage tips for first-time home buyers. 1.