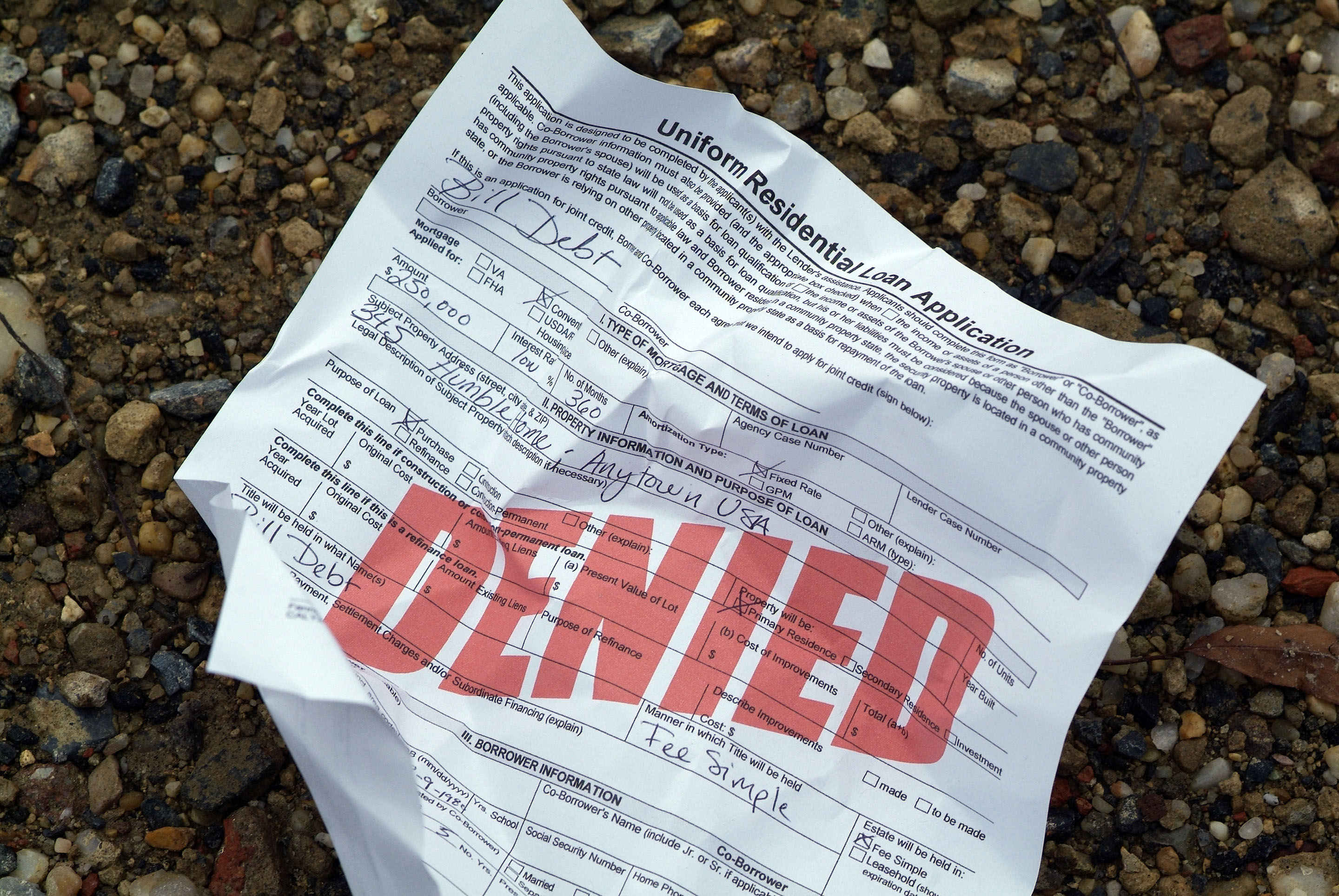

Can I Refinance While Buying a Second Home?

Say you’ve found a property that will be a great investment at a bargain price. Or perhaps the beach cottage you’ve had your eye on for years just came on the market. Whatever the reason, if you’re considering applying for another loan while refinancing your current home, the process can be somewhat complicated. To give you the full picture, Realtor.com