You’ve been pre-approved for a mortgage, found the perfect home and had your offer accepted. All you need to do now is sit back and wait for closing, right? Well, not exactly.

While the odds are reasonably good that nothing major will go wrong, that doesn’t mean things can’t go wrong.

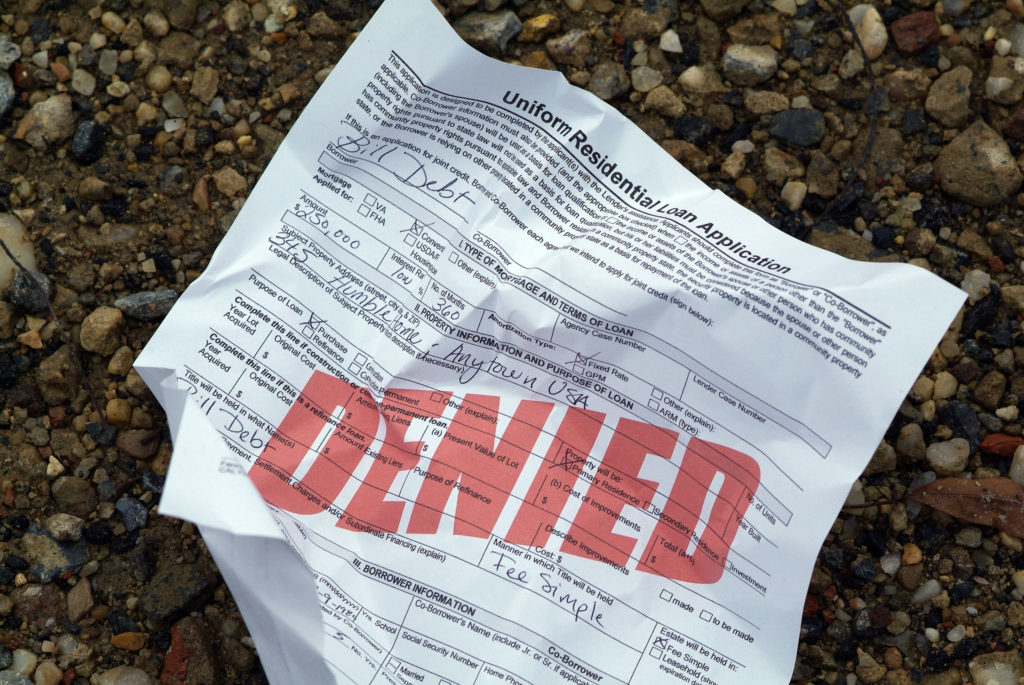

A financial misstep now could change your mortgage terms and interest rate, or even get you denied altogether—even if you have a closing date on the books. To make sure that doesn’t happen, realtor.com suggests that you avoid these less-than-savvy money moves.

1. Moving money around

If you’ve been storing up cash reserves, do not move that money out of savings and into stocks while you wait to close. Although you might like to make some extra cash off those reserves, remember that it’s showing your liquidity. Moving money around can cause problems with your loan approval because lenders are counting how much money you have going into closing.

With savings, lenders count that as 100 percent, but with stocks, they only use 70 percent of the value because stock prices can change. So, if you have $100,000 in savings and you move that into stocks, suddenly you only have $70,000 from an underwriter’s perspective.

You’ll need enough cash to cover the down payment, closing costs and at least three months of mortgage payments. If the stock deduction dips your assets too low, you could be looking at a denial.

2. Taking a leave of absence from work

Lenders rely on you being willing and able to work after they approve your loan because it’s the only way to prove you’ll make those monthly payments.

Things can happen, and sometimes you might have to take a leave of absence, but don’t risk it unless it’s completely necessary—or unless you’re prepared for your mortgage to get delayed or denied.

If you take a medical leave right before closing, for example, you might have to wait for two more paychecks to prove you’re back at work.

3. Applying for new lines of credit

Applying for a new credit card or requesting a credit limit increase a few months before closing probably won’t harm you too much. But don’t let the credit inquiries mount. Worse than the actual hit on your credit score is any pattern of trying to borrow more money from more companies all at once.

This suggests you are not wise with your money and just out running up debt you may not be able to repay. Rather than trying to determine how many credit inquiries is too many, or how much new credit you can take on without getting your mortgage denied, leave the applications alone until you’re through closing.

4. Going on shopping sprees

Buying a new home is exciting, and you’ll probably want to go out and buy new furniture and appliances. But don’t get too carried away. Lenders often run credit reports within hours of the scheduled closing, so running up new large debt is a bad idea.

It can change debt ratios, change your interest rate, and even lead to a lender deciding you have too much debt and you’re not worth the risk anymore.

5. Taking a new job—even a better-paying one

Getting a new job halfway through the home-buying process disrupts an already tedious paperwork process. That said, some moves are more OK than others—like getting a promotion within your company or even making a lateral move to another. Lenders are less OK if you switch fields.

Even with a potential pay increase, that kind of switch is seen as too risky to mortgage lenders because you don’t have a proven track record of being able to work in the new field. Lenders want to feel secure knowing that you can repay the loan. Making changes—particularly to your primary source of income—isn’t seen as stable as remaining in a job long term.

Even if you do remain in the same industry, you should beware of switching into a role where your income is largely dependent upon bonuses or commissions—even if your annual income will end up being higher than your current position. Lenders can’t see what you haven’t earned yet, and they’ll factor that into your mortgage approval.